After a year as unprecedented and unpredictable as 2020, it’s important to take an extra-long look at what the future may have in store. For that reason, Keller Williams Executive Chairman Gary Keller, KW Head of Learning Jay Papasan, and KW Chief Economist Ruben Gonzalez reunited for Vision Revisited: a deep dive into the numbers driving real estate, emerging trends, and what it will take to win the market of today and tomorrow.

Rather than trying to cram every data point and insight into the Vision Speech of this year’s Family Reunion – real estate’s largest training event – Keller made the astute decision to spread their collective knowledge across two installments. Part one of this duology did an excellent job mapping the challenging landscape that lies ahead for the real estate industry, but the short-awaited sequel is what reassured Keller Williams agents that their brokerage is prepared to survive and thrive through whatever lies ahead.

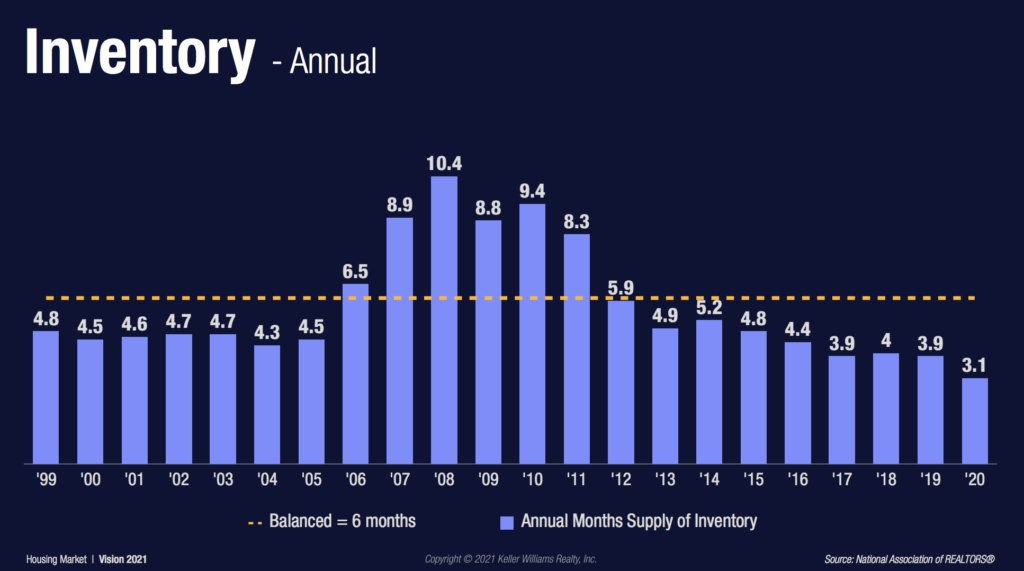

With no stringent production schedule limiting their discussion time, Keller and his companions spent over two hours charting a path forward for their loyal viewers. Topics ranged from how to be the “economist of choice” for clients to how to win listings during a record-low inventory shortage, and by the time Keller waved goodbye, those who tuned in were begging for more.

For those who missed it, read the highlights and key actions you can take today to excel in any market: download the slides.

Learn how to be the economist of choice.

During the presentation, the trio explored the state of the U.S. economy and housing market – looking at factors including unemployment, GDP, and inflation, as well as inventory, home sales, mortgage rates, and more. Having an understanding of these numbers, particularly sales trends, pricing trends, available inventory, and days on market, are crucial for establishing a trusting relationship with your client. And, while it’s smart to have a general understanding of national numbers, it’s more important to review your local MLS for the most accurate market picture, so you can help your clients navigate the current landscape with confidence.

“If you understand the numbers, you will have a sense of how the economy is going and be able to sit down with your buyers and sellers to be the economic authority of choice,” said Keller.

A couple stats that will help you keep a general pulse on the health of the economy and market:

- Unemployment: A healthy unemployment rate should fall below 6%. Prior to the pandemic, the United States was at 3.5% unemployment, which at its highest point ballooned to 14.8% in April and by the end of 2020 was 6.7%. Those in the financial sector are nearly back to full employment with only a 3.4% unemployment rate, whereas those in leisure and hospitality are at a 16% unemployment rate. It’s important to note who is being impacted at this time and recognize, “It has been two different experiences for various groups of people, depending on what they did and their income level,” Papasan noted.

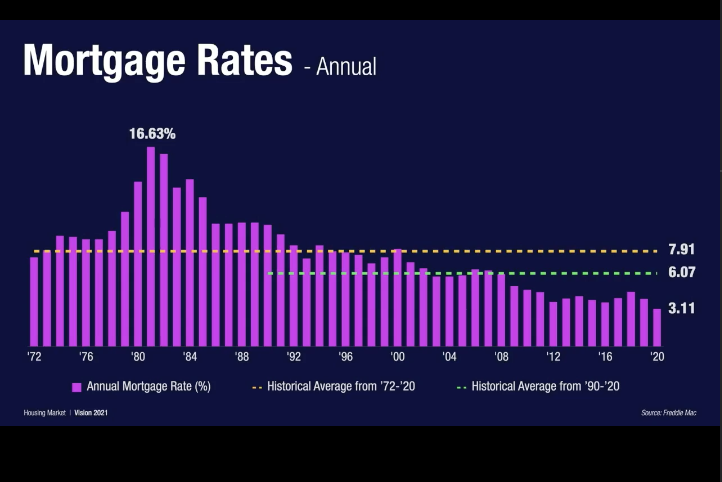

- Mortgage Rates: By the end of 2020, mortgage rates were at an all-time low of 3.11% compared to the historical average, 6.07%.

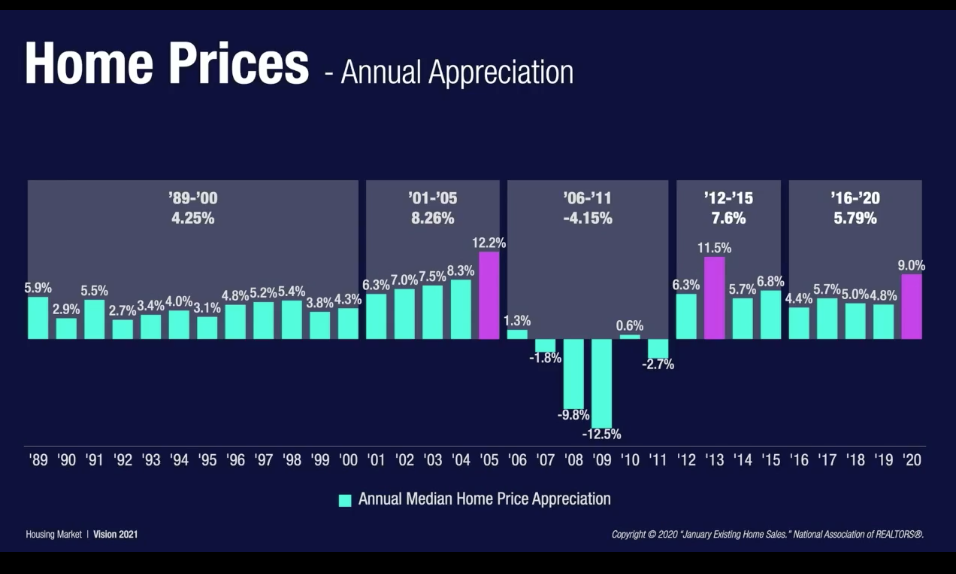

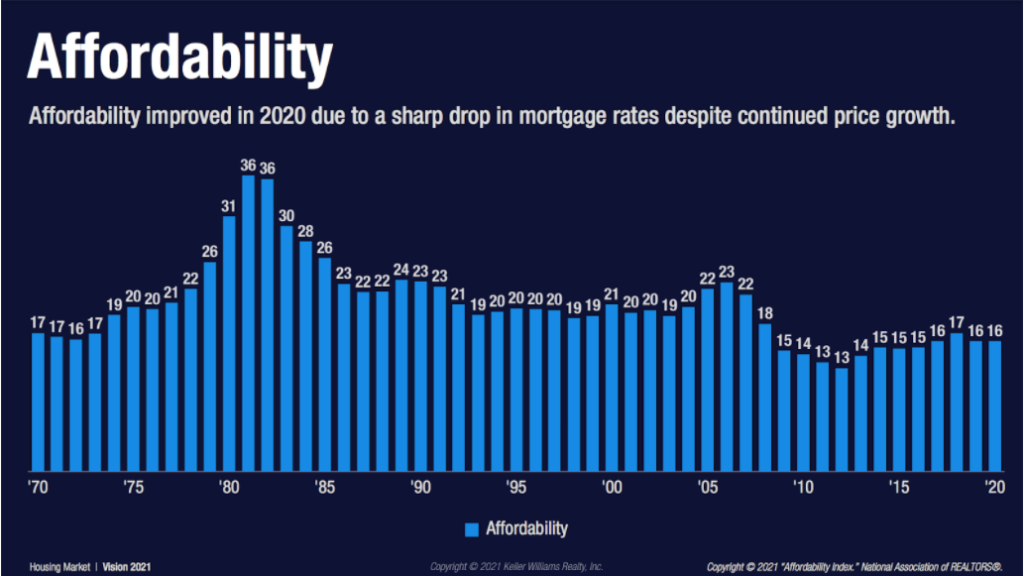

- Home Prices/Affordability: With low mortgage rates, the market is ripe for continued acceleration and growth, especially with home prices. However, it is important to note that low mortgage rates helped offset growth in prices, supporting affordability even with a 9.0% appreciation in prices.

- Gross Domestic Product (GDP): Or, the value of all finished goods and services made in a country within a specific time frame, took a massive hit in the United States within the first two quarters of 2020. Ultimately, it rebounded and ended the year at -3.5%. What does a healthy GDP number look like? According to Keller, anything above two is a great number. Once you start dropping under that, the economy begins to feel sluggish and anemic.

- Inflation: A healthy inflation rate stands at about 2%. Currently, there is some concern that relief packages offered during COVID times may lead to inflation, but Keller and team don’t believe that to be the case. “They (the Federal Reserve) are much more concerned with deflation – the prices of things dropping – versus prices going up. There are a lot more tools to deal with inflation,” he reminded the audience.

Keep your lead generation consistent and the timing will find you.

Over the span of Keller’s career – complete with market booms and crashes – one activity has remained at the center of his success and subsequent teaching: lead generation. During the presentation, Keller came back to it again with an important message for anyone tempted to chase the market. “The trick is to always lead generate and never stop, which means timing finds you,” he shared. “You cannot time the market, but if you’re always in it, timing will regularly find you and will reward you more than other people.” If you want to build an amazing career, keep lead generation at your core and remain consistent.

Lead generate for listings.

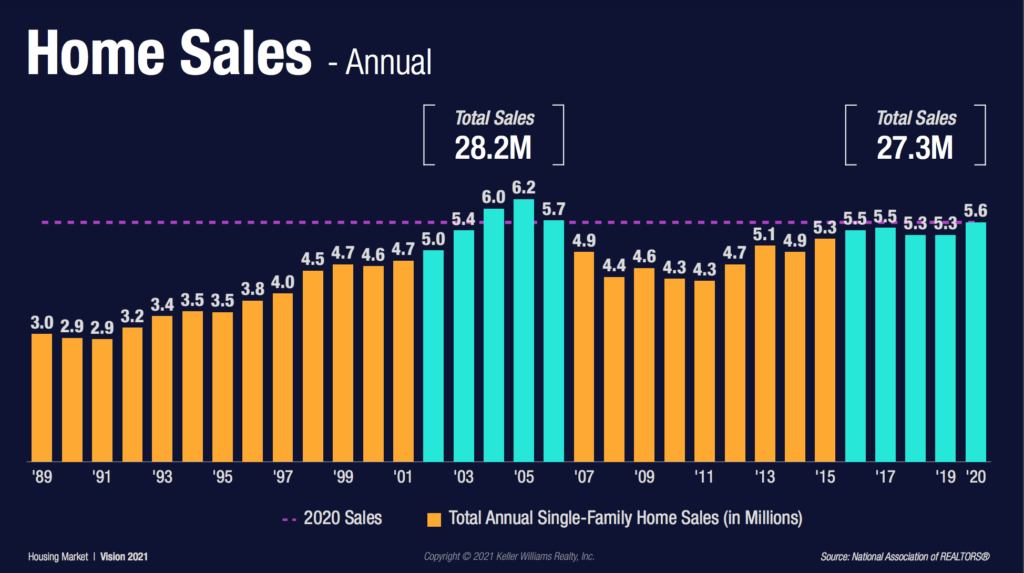

For many agents, 2020 was an incredibly fruitful year. In fact, “If you had a tough year, you need to reexamine your lead gen and customer service techniques,” Keller said. “Because there were more transactions going on than at almost any other time in history.”

Coming off of a strong sales year, agents are now sitting on the lowest inventory ever recorded. As such, in 2021, listings are the name of the game.

“We’re probably close to 90% of listings coming off the market in the first month,” Gonzalez said. However, this does not mean that there is low opportunity – it simply means that other areas of the real estate industry must be explored. “You can expect new home sales and forbearance sales could absolutely increase the inventory in the next 12 months,” Keller said. Now is the time to be “knocking on doors, sniffing around land to help the builder-developer get land. That way, you’ve got your listings for the next year or two.”

Stay in relationship with your sphere.

In the National Association of REALTORS® 2020 Profile of Home Buyers and Sellers, Keller pointed out how people are choosing to work with Realtors at a higher rate than they were previously. However, the report also reveals a follow-up gap, indicating that agents are not consistently staying in relationship with their clients:

- In 2020, 88% of homebuyers and 89% of sellers used an agent.

- Yet, only 13% of buyers and 26% of sellers indicated that they found their agent because they worked with them previously.

“With an abundance of information out there, people want to work with a real estate agent. Your mission is to get yourself in front of them and stay in relationship with them,” shared Keller.

He continued by setting the scene for what this looks like: “You’re doing your lead generation, putting people in a database, and meaningfully touching that database on a regular basis to build those relationships so that you are their source of truth. People would prefer that.”

Share your value proposition proudly.

The same report revealed that only 40% of agents ask their clients to sign a buyer representation agreement – a number the trio agreed should be much higher. Why? Because as an agent, you should try to have a paper trail of the relationship you are entering with clients by getting them to sign a buyer agreement, Keller reminded.

“When you ask someone to sign an agreement, you have to offer something,” added Papasan. In this process, you may encounter some level of fear that you won’t be able to portray your value highly enough for someone, therefore they may say no. But an important step toward gaining that confidence is mastering your comfort level with dialogues and scripts, so you can share your value proposition in a confident manner. Think carefully through your value proposition, and skim through the Outfront scripts archives for detailed script resources.