Many people confuse being “rich” (having a lot of money) with being “wealthy” (owning assets, such as businesses or real estate that generate money for you). Financial wealth isn’t about reaching a milestone figure for your net worth so much as it is about creating a sense of security and freedom.

In The Millionaire Real Estate Investor, Gary Keller and Jay Papasan write that “Financial wealth is about having enough passive income to finance your life mission without the need to work,” (p. 40). When you believe that “Money is good for the good it can do,” rather than the “good it does me,” you open up an opportunity to make lasting change for others – adding a depth to your financial wealth goals.

Real estate investing is a spectacular vehicle for gaining wealth and affecting substantial change. And the best part is that anyone can be a real estate investor. And, as a real estate professional, you have the privilege of already being an expert on this massive wealth-building opportunity. When a listing for a potential investment opportunity comes on the market, you’re one of the first to know – and you’ve got the skills and knowledge to understand what makes a property likely to appreciate significantly over time.

In our experience, there are three major myths that keep people from investing. Confronting these “big three” will help break down those fears and put you on a path to achieving financial wealth.

Myth 1: I don’t need to be an investor, my job will take care of my financial wealth

Truth: Yes, you do need to be an investor, your job is not your financial wealth

When many agents first hear about real estate investing, they tend to think about themselves as someone whose primary job is to help other people buy investments. Yes and no.

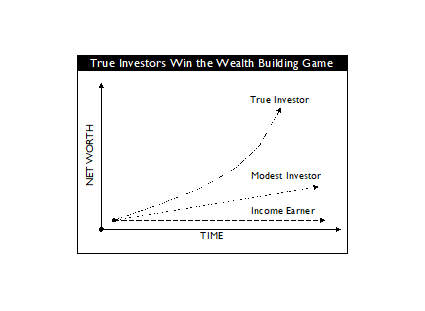

Rather than choosing a high one-time net income, think about real estate investing as a way to long-term increase your net worth. The truth is that investing is the only activity that can increase your net worth exponentially.

One of the biggest issues with solely relying on your income as a path to wealth is that it puts your wealth outside of your control. You may generate a great deal of income from helping other people invest in property, but that income is a one-time transaction. You could have a great income stream one year, only to have it dry up the next. Even if you save that additional income, at an average rate of interest, it likely won’t appreciate at the same level those properties would have to help you achieve financial wealth.

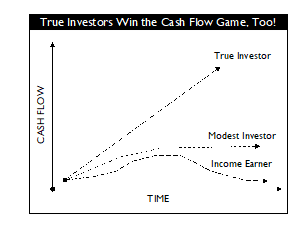

This can also be true for people who own their own businesses – if you are unable to work or decide it’s time to stop working, without leverage, your cash flow ends.

Investing is an opportunity to secure your long-term financial security and to keep active cash flow if you stop working.

At Keller Williams, we also have the opportunity to make investments in people. By participating in profit share, you can also establish passive income to fund your dreams.

Myth 2: I don’t want or need to be financially wealthy – I’m happy with what I have

Truth: You need to open your eyes – you do need and want to be financially wealthy

If there’s anything that this past year has taught us, it’s that we have no idea what we’ll want or need past today. We cannot predict what life will offer us – good or bad.

Becoming an investor is all about preparing for life’s ups and downs. If you don’t choose to pursue financial wealth, you may have to scramble. In the face of substantial changes or shifts, you may have extremely limited financial choices. You might work overtime to keep the job and income you’re earning. You’ll take second jobs to make up for cut hours. Pouring more into keeping what we have doesn’t help us in the long-run – it puts us at a loss.

Even in booming markets, it’s easy to jump to the negative when you’re considering rocking the boat and investing. But consider the unforeseen opportunities you may have in the future, too. Some agents use real estate investing to establish new expansion markets for their businesses.

Investing not only lets you imagine how big your wants and needs might become, but it allows them to become possible. Investing allows the financially wealthy to create the means to fund their dreams.

Myth 3: It doesn’t matter if I want or need it – I just can’t do it

Truth: You can’t predict what you can or can’t do until you try

Like Gary and Jay wrote in the The ONE Thing and The Millionaire Real Estate Agent: the most harmful myths have to do with thinking “I can’t do it” and that “big is bad.”

What exactly is your ultimate potential? It’s impossible for you to know. No matter what your circumstances may be, when you set out to achieve something, always begin with the truth that you won’t know until you try.

Investing works the same way. There’s no way for you, or anyone else for that matter, to know your true financial potential. And, because your true potential is unknown, it makes no sense to place limits on it. As you make your first attempt, more will become clear to you, and only then will you understand what’s possible and what isn’t.

We hope that you now believe that your job is not your financial wealth, that you both want and need to pursue financial wealth, and that true financial wealth is possible for you no matter where you are in life. The “big three” MythUnderstandings are some of the most powerful limiting beliefs you can have. By taking a deep look inward at these fears, we further hope you’ll be able to use them to fuel your goals and ambition.

I agree with you Gary Keller, when he says Financial Wealth is the Passive income that will finance my Future mission without the need to work.

It should provide me with Security and Freedom.

As I write this message, I have been haggling with Real Estates Wholesaling business as one of my easiest entry to the Real Estates industry. It’s been a long rough journey for me for over five years on the road now, & having bought Gary Keller and Papasan Guide to Investing book from one of our large Ugandan bookshops, not because I could afford it, but because it was sales promotions,& I could afford that. Iam happy I made the right decision to buy and read through it several times,and that’s what opened my eyes to Real Estates Business.

I then thought of Free Lancing with established RE companies after searching for KW in our Uganda data base, & didn’t see any apart from South Africa, that made me try working with Re-Max temporarily as I veared my way to Solo as a Commission Agent through Wholesaling and Match-making deals with investors.

I have not achieved any thing yet,but I am satisfied with the motivation and experience I have achieved with good Network of contacts without taking any Real Estates Certification course since I can’t afford it at the moment, it’s my Goal to do some training one day, because I have a big plan to become Real Estates investor in my country. I have read most Successful stories from those who have made it in Real Estates Business, they are not far from what I am going through now.

It’s only Motivation and Courage that counts on my journey to Success.

Thanks Gary Keller and Papasan for showing me the way from your Guide to Investing book.

OTAI SAMUEL

KAMPALA

UGANDA

Hi Otai! Thank you so much for your comment. We’re glad to see Gary’s message reaching global heights. For more financial freedom content, take a look at the Outfront archives:

Outfront Wealth-Building Archives