“It’s good to see you, and it’s good to be seen by you,” KWRI Co-Founder and Executive Chairman Gary Keller said as he walked on stage to the roar of thousands of cheering real estate professionals for the first time in two years. To give a sense of how badly agents missed the in-person experience, panelist and KWRI Head of Industry and Learning Jason Abrams shared the story of an agent named Leo who braved 26 hours of travel and three layovers to get from Spain to Orlando. “Y’all better be good,” Keller jokingly implored Abrams and the two other Vision panelists: KWRI VP of Strategic Content Jay Papasan and Chief Economist Ruben Gonzalez.

Keller kicked off the Vision Speech with a reminder of its purpose: “We call it the Vision Speech only because in order to understand where possibly things are going and what we need to do to be prepared for them, we have to look backward and try to understand what just happened.” The panelists began with a thorough assessment of the numbers that drive the U.S. real estate market.

Home Sales, Prices, Inventory, Mortgage Rates, and Affordability

“2021 was the greatest sales number in the history of the real estate industry,” Keller began, while also acknowledging that those historic numbers don’t mean the same for everybody. “What’s fascinating is that some people can have their best years in a down market and some people have their best years in the best markets. So don’t worry too much about what the market is doing in the end. Focus on your main activities of finding men and women who want to do business with you. If you can do that, the market will not totally drive your career.”

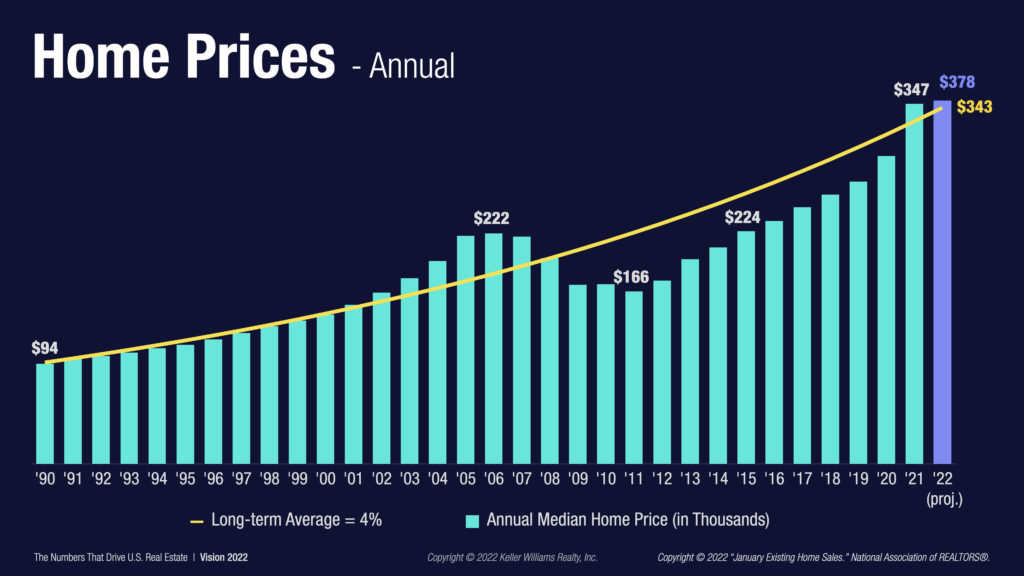

Another record-breaking number the panelists paid close attention to was the median home price, which is projected to hit $378,000 by the end of this year. As the accompanying chart illustrates, that historic figure clears the 4% long-term average increase, a feat no one saw happening so soon after the Great Recession. “It would take about seven years, give or take, at like 2 to 3% appreciation per year, to get back down on that trend line,” Gonzalez calculated, noting that this is something they will be keeping a very close eye on over the next two years.

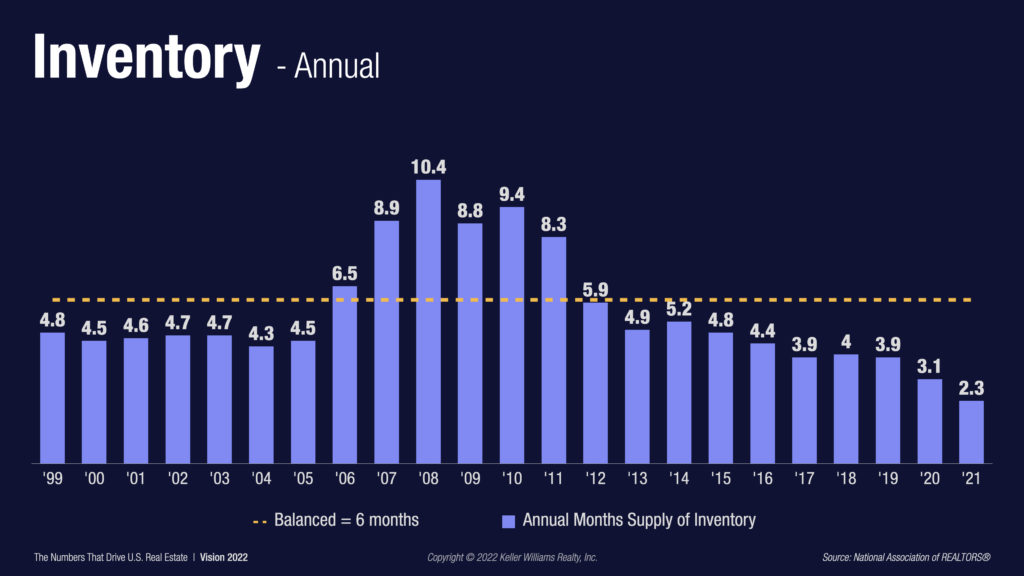

One reason for these unprecedented home prices has to do with the equally remarkable inventory shortages, which fell as low as 1.9 months in January of 2021. This trend is especially surprising when you consider 21 million people lost their jobs in 90 days at the start of the pandemic. “In the worst unemployment period ever, we still only had a 4.6 month supply,” Keller said with a baffled laugh. “I mean, you would have thought we would have 100 months or 200 months.” But Keller also pointed out a discrepancy between the low inventory and the record-breaking sales of 2021. “In order to sell 6.1 million homes, you had to have 6.1 million homes to sell. So it’s not that you didn’t have the inventory. What you had were instant sales.” In other words, homes sold so fast, there wasn’t time to add them to the inventory calculations.

3.9% the Thursday before Family Reunion. Gonzalez described the mortgage market as a “moving target,” with rates likely to increase and decrease over the next year and likely settling somewhere around 4.5%. To put that in perspective, Keller reminisced on how interest rates were at 17% when he first entered real estate in the late ’70s, and he still managed to sell six houses in his first month. “People will still buy and sell, you guys,” he reassured the audience.

The panelists rounded out the U.S. real estate market portion of the Vision Speech discussing the tale of two affordability statistics. According to the chart, affordability is currently sitting at 16% of the buyer’s income, which is pretty consistent with where things have been since the Great Recession. What the chart doesn’t show is how that number differs for first-time homebuyers. “It takes 24% of the first-time homebuyer’s income to buy their house,” Papasan pointed out. “It’s a big jump, and we also know that they are carrying a lot of school debt, which complicates it and is pushing their purchase back.”

For the sake of comparison, the panelists took a look at Canada’s market, which is similar to the U.S. except for two areas: home prices and affordability. “In Canada, what goes up, will be higher tomorrow,” Keller marveled. The panelists attributed this unmitigated increase to foreign demand and population density, with 24% of Canadians living in either the Vancouver or Toronto area. When you take those factors into account and adjust for the currency difference between the Canadian and U.S. dollars, our markets begin to look a lot more similar. That is, until you look at affordability, which Canada calculates using taxes, insurance, utilities, and America’s only two figures, the principal and interests of mortgage rates.

The Inflation Situation

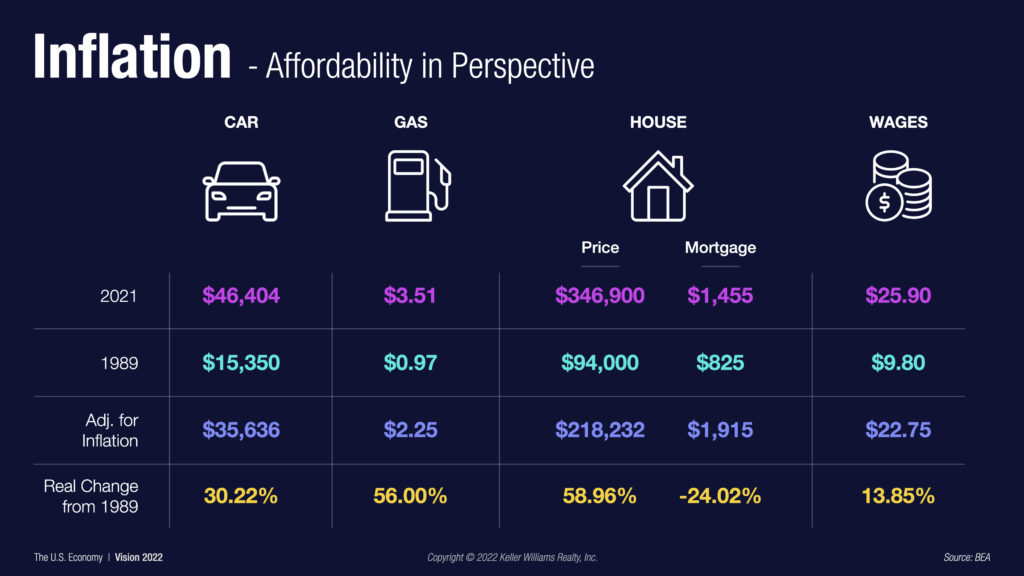

To put affordability into even greater perspective, the panelists devoted a solid chunk of the presentation to inflation. “The number one threat to democracy is inflation, because inflation favors the rich and harms the poor,” Keller proclaimed. To illustrate this point, the panelists dissected a chart that shows how inflation has shaped what we pay for cars, gas, and homes compared to wages.

By comparing the costs and wages of 1989 to what they are now, we can see that column increased significantly except for wages and mortgages. Since 1989, the price of cars has increased by over 30%, the price of gas has increased by 56%, and the price of houses has increased by nearly 60%. However, wages have increased by less than 15%. Although mortgages have trended downward over that span, it doesn’t fully make up for the fact that wages continue to lag far behind the rapidly increasing prices of consumer goods.

The Industry at Large

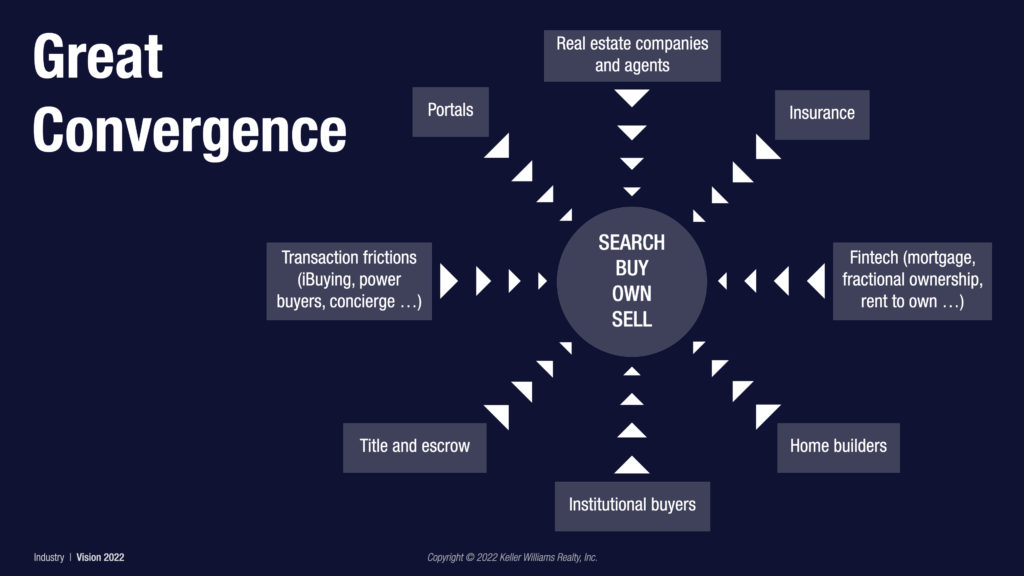

After spending the majority of the speech looking deep into the numbers, the panelists closed by taking a broad look at what’s happening in the real estate industry as a whole. Keller identified their biggest finding as the Great Convergence, where every real estate company is racing to find a way to help consumers search, buy, own, and sell homes.

“Everybody is in the real estate business,” Keller explained, referencing the entities on the screen other than real estate companies and agents. “And, by the way, they’re all in search of more profit, and because they’re all in search of more profit, they’re all going to converge toward the middle.” To illustrate this point, he mentioned how a certain heavily marketed mortgage company that reportedly handled 9% of all mortgages last year is now experimenting with salaried agents in Detroit. “Are they in the real estate business?” Keller asked, “Heck yeah, they’re in the real estate business.” Keller concluded this prediction with a piece of advice for the agents in attendance. “Do what you need to do to help your buyers and sellers, and for you to run your business in a way that makes you the most amount of money,” he encouraged. “Just keep an eye out and understand that every vendor that you do business with is absolutely headed toward taking more money from you eventually.” It’s for this reason KW created Keller Covered, and all the technology agents and teams need to prevent third parties from taking money out of their pockets.