Before laying the foundation for the future of real estate, kwx’s executive chairman Gary Keller addressed the elephant in the audience-less Austin Convention Center. “Let’s start off by talking about the real estate industry in the U.S. And, by the way, the topic is real simple: it’s COVID, COVID, COVID.”

Joined by VP of strategic content Jay Papasan, chief economist Ruben Gonzalez, and head of industry Jason Abrams, Keller and team kicked off Mega Camp with an in-depth analysis of the current real estate market, how it has been impacted by COVID, and what agents will have to focus on in 2022 and beyond. If you couldn’t tune in to the live presentation, here’s what you missed.

A Tale of Two Pandemics

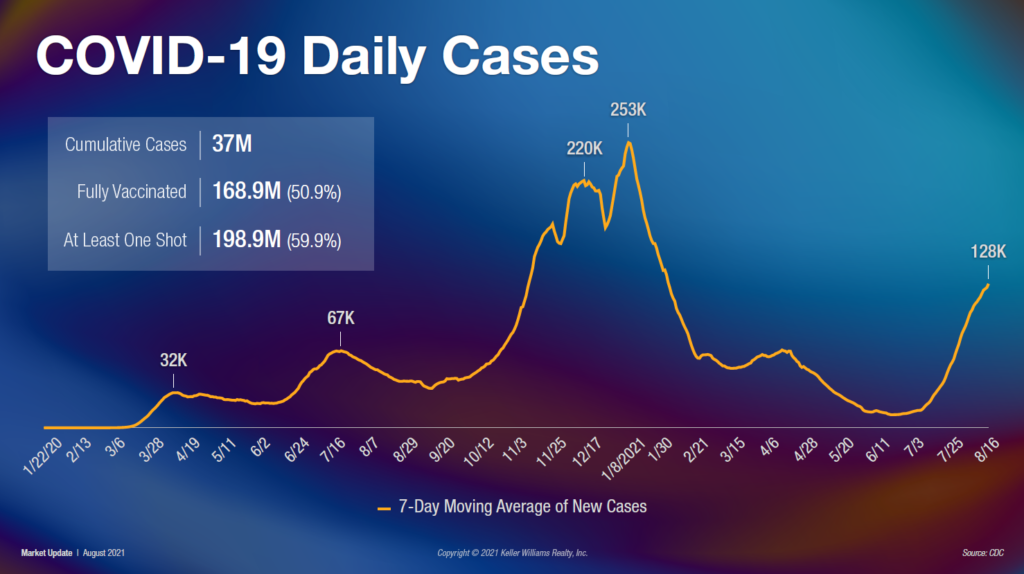

As the chart illustrated, the daily positivity rates are rising as fast as they were last November, before vaccines were readily available. Unfortunately, due to a more contagious strain of the virus and lagging U.S. vaccination rates (only 50.9% of Americans were fully vaccinated at the time of the presentation), COVID-19 once again threatens to disrupt multiple industries, including real estate.

“This is a pandemic of the unvaccinated,” Keller proclaimed. “If you’re asking yourself as a businessperson, ‘how do we get out of that,’ – again, setting aside any personal beliefs, or whatever about this – it’s going to be through vaccination. It’s going to be through masks.” Abrams confirmed this observation by analyzing the fluctuations in the graph towering over them. “There’s this idea that somehow things are out of our control and we just simply rely on faith. But here’s the thing, in each one of these massive dips, behaviors changed. And so, I look at it and I’m hopeful that we can control it.”

Home Sales Are Still Hot

To lighten up the mood from all the COVID precautions, Keller and his panelists transitioned to the projected 5.9 million single-family home sales taking place in 2021. “You do realize that’s the fifth-best recorded year in the history of the industry,” Keller pointed out, quelling the nerves of anyone worried about the current state of the market. To capitalize on this impressive productivity, Keller reminded agents about the importance of keeping in contact with their sphere. Unlike 2020, when uncertainty surrounding the pandemic shifted the majority of home sales to the second half of the year, this year’s relatively normal spring set the stage for a higher percentage of first-half home sales (49%) than we saw back in 2020 (41%). Due to this shift, the National Association of Realtors estimates second-half home sales will drop from 59% to 51%, meaning agents should expect less activity than they experienced the second half of last year.

As the seasonality gave way to home prices, Keller was noticeably startled by how quickly the market returned to the 4% trend line in the last year – an event that hasn’t occurred since 2008. “That 15% jump, potentially, we’re looking at this year is huge,” Gonzalez noted. “The last time we saw something like that was 2013 coming off the great recession.” Combine that with the 13% increase we saw in 2020, and you’re talking about a 28% increase over the last 24 months. Gonzalez put those staggering numbers in perspective by equating them to a rise as big as the median family income. “Any time you see prices going above that 4% line, there’s going to be a price correction,” Keller prophesied. When that will happen exactly remains a mystery.

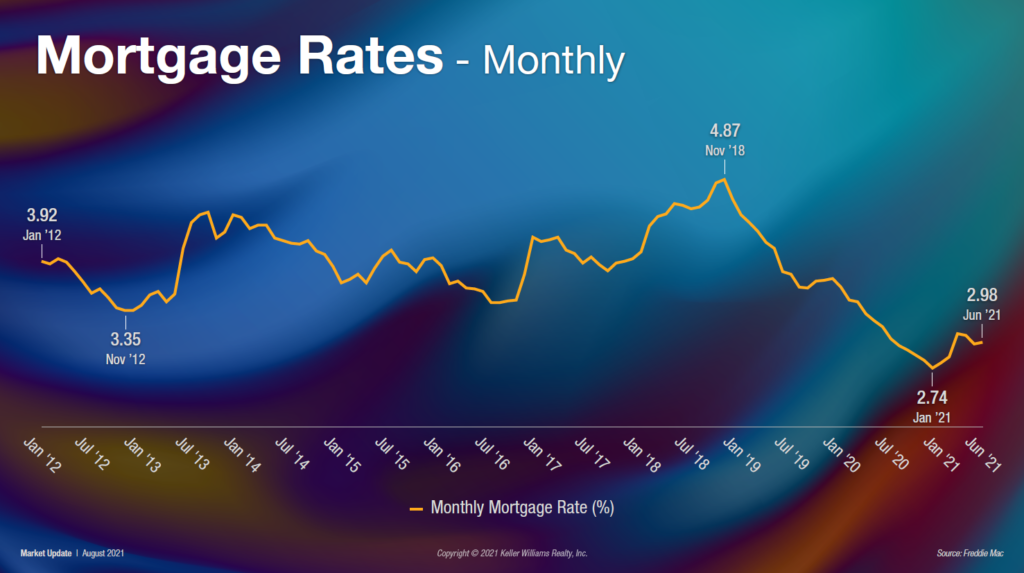

Despite this rise in home prices, Keller reminded agents, “It’s always a good time to buy or sell, depending on your motivations.” Thanks to mortgage rates holding below 3%, many buyers are finding the favorable interest rates counteract the inflated bids. “The truth of the matter is, it’s never the fault of the real estate if you lose money and it’s never the credit to the real estate if you made money: It’s all about timing,” Keller explained. For relaying this information to a client, he made it even simpler. “If you intend to live [in a home], for at least seven or eight years, you’re good to go.”

Competition Continues to Be Fierce

Anyone who has been following real estate knows that inventory shortages are nothing new, and last year’s construction stoppages and supply chain disruptions didn’t help matters. Fortunately, the U.S. supply inventory rebounded by nearly a month (2.6) since last December’s low of 1.9. Unfortunately, recent natural events (delta variant, wildfires, etc.) could potentially halt that progress. For this reason, Keller urged agents to start thinking about how they will land their future listings now.

One potential source of inventory agents should keep their eye on is forbearance. Analysts predict as many as 1.6 million homes may be coming onto the market due to forbearance in the coming months, but unlike the Great Recession, these homeowners are not “underwater,” as Keller put it. Although these clients may be giving up their current home, they will likely have the resources to quickly move into their next one, which presents an amazing opportunity for real estate agents to prove their value.

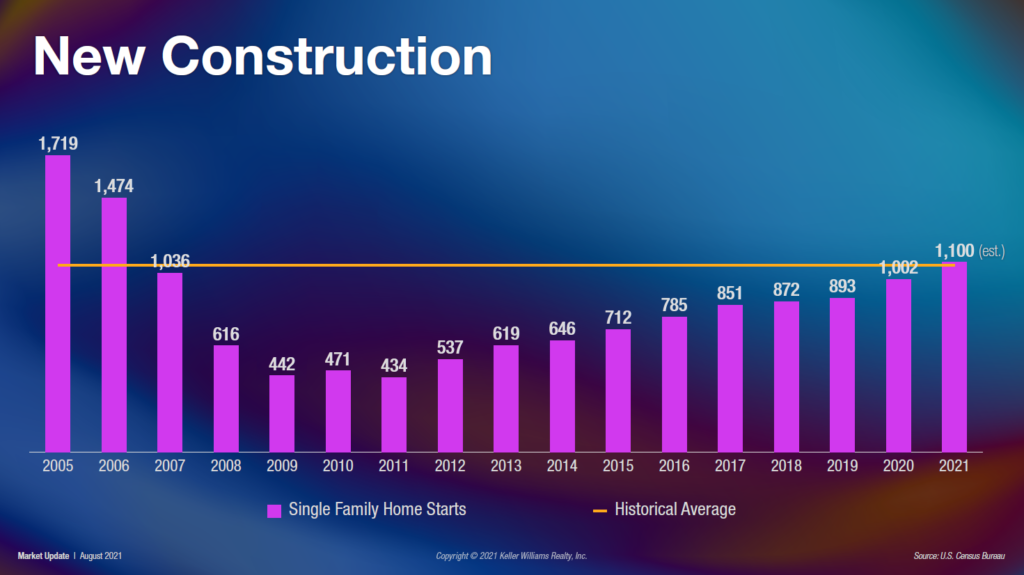

Another important source of potential inventory comes from new home construction, which is finally in step with the historical average for the first time since 2006. With new homes now making up 16%-20% of the market, Abrams can’t stress enough how important it is to stay on top of this emerging sector of real estate. “In every single market center, there better be a group of people who wake up every day thinking about new construction,” he insisted. “If that’s not happening, make it happen.”

Abrams isn’t the only one at Keller Williams who is bullish about new home construction. In fact, the company just introduced the KW New Homes community shortly before Mega Camp. This partner program with Legacy International aims to provide agents with the education and resources they need to expand their portfolio and embrace the potential that this burgeoning segment represents.

Reinventing the Real Estate Company

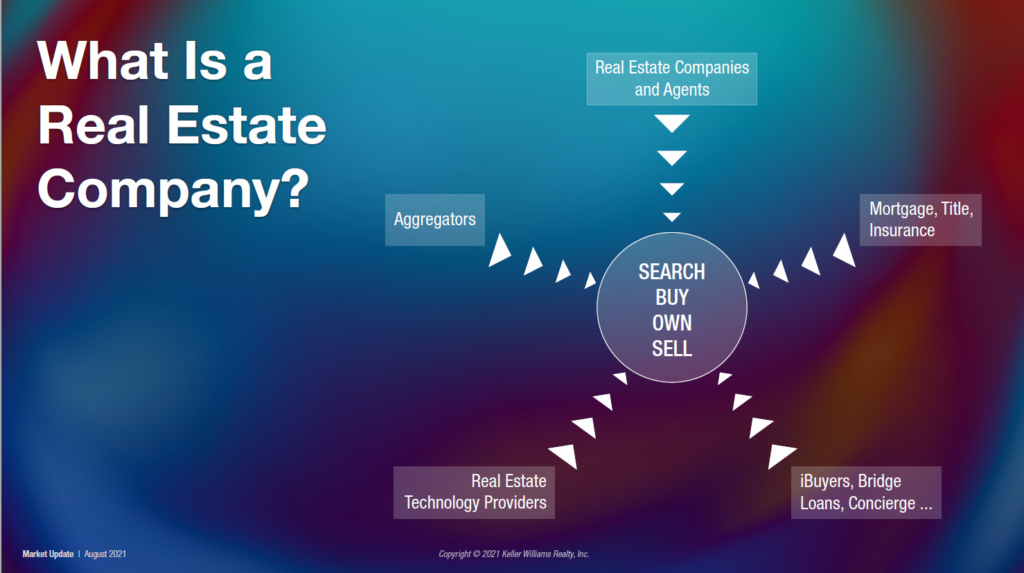

Keller and crew closed out the Market Update with a discussion about the biggest disruptor in real estate and all industries: technology. “Do not be misled about what’s happening in our industry,” Keller cautioned. “There’s a continual march toward digitally based, physically enhanced.” To validate his claim, he referenced the hundreds of millions of dollars pouring into real estate from outside investors trying to define what the future real estate company is going to look like. According to Keller, it will look a lot like a convergence between two of the industry’s biggest players. “The top agents will be running their businesses like general brokerages, and general brokerages will be running it like top agents.” Despite these similarities, Keller tempered the fear of heightened competition. “The fact that you’re providing the same services doesn’t mean you’re competing,” he suggested. “The only time you’re competing is when you both show up at the same table trying to get the same seller. Then you’re competing, and that’s going to happen once in a blue moon.”

Keller went on to discuss the other most pressing convergence, which is the one taking place around the search, buy, own, and sell experience. “There’s a lot of talk around owning the transaction, but I want you to realize that’s just a small piece of what’s really going to change,” he claimed, noting the other branches of the real estate industry currently being overtaken by technology providers. “Every one of [these providers] is realizing that if they stay isolated, they’re out on an island by themselves, and they will all start moving toward the middle.” What does Keller think this means for traditional real estate companies? “We need to move faster to the middle, because whoever gets there first is going to define [the future].” With that prophetic realization in mind, it becomes easy to see why KW has amplified its push to unite agents, mortgage lenders, insurers, and every facet of the buying and selling process under the same roof.

Download the Market Update Slides