Success is more than just a number in your bank account.

It’s personal. And growing wealth is more than just building an even bigger business. Wealth means freedom, giving back to others and your community, and taking care of your family.

In the newest season of “Think Like a CEO,” Gary Keller and Jay Papasan – authors of The Millionaire Real Estate Agent – take a deep dive into wealth building:

- Debunking common myths

- Detailing steps to help lead to your financial success

- Outlining mistakes that may be preventing you from experiencing the financial freedom you desire

Drawing from real-life experiences and insights from fellow entrepreneurs, Keller and Papasan give listeners a better understanding of money, as well as the know-how to approach it with confidence. Here are just a few of the big lessons we took from the new season.

Lesson 1. Wealth is a mental state which takes a physical form.

In episode one, Keller and Papasan expertly peel back the layers to reveal what financial wealth is and how to actively pursue the passive income that will allow you to achieve it; both serve as crucial cornerstones of your wealth-building journey.

Keller: The real purpose of financial wealth is for you to be able to finance your personal mission; it’s about having enough unearned income to finance your life as defined by your purpose.

And the thing that I’ve come to understand is that wealth is a state of mind. The truth is the most common mistake that we make in life is looking outside of ourselves for what we should look inside. And by the way, success is no exception. Just as the source of true happiness lies within each of us, success also comes from within. So, success is the result of a very specific mental attitude: I know what I want and went out and got it; it’s an inside to the outside approach.

Financial wealth is the same thing – the outward manifestation of an inner focus. It starts with why you want it and the way you think about it, and it turns outward and manifests itself in the money that you actually earn and keep. So, it’s the result of steering your thoughts toward a very specific financial target.

Lesson 2. To generate passive wealth, become an active investor.

In episode 2, Keller and Papasan explore eight MythUnderstandings between you and your financial wealth, beginning with the importance of an investor mentality. Many people make the mistake of thinking that their jobs will take care of their financial wealth and shy away from becoming investors. Keller and Papasan respond with an important dialogue:

Keller: Even if you have a job that pays you money, when you quit working, they’re going to quit paying you. So, when thinking of your freedom date or your retirement date, you will have had to have invested your money so that it now works for you. It’s, ‘I work for money. My money works for me.’ When I work for money, it’s a job. When my money works for me, I’m an investor. So, I’m going to have to become an investor.

Papasan: If you had even a 401(k), and for a lot of people, they might be setting aside 4 or 5%, maybe even getting a match from their employer. So, in that sense, they get a dollar, and maybe 5 or 10% is going into investing. And that might take care of your minimums, but you’re not being the kind of investor that knows the number they’re trying to work backward from.

One of the fundamental differences about being an investor is having a target that you’re working backward from; that’s how you get to the wealth and abundance.

Lesson 3. Investing is not risky once you recognize value.

In episode two, Keller and Papasan continue a rich conversation on investments and illuminate the truth behind a common myth: Investing is risky. I will lose money.

Keller: The truth is, investing by definition is not risky.

Papasan: Yes. I think people confuse speculation with investing. They’re two very different things.

Keller: That’s exactly right. Investing is investing. And that means you buy below value. That’s it. When you buy above value, you’re speculating that the price will go up and up and will cover the fact that you did not buy below value, you bought above value. That’s the problem. And most people, by the way, are speculators. They don’t know the value and they overpay.

And now, they have a problem. You see real estate appreciate at the rate that it’s been appreciating, right. And it will literally bail you out if you hold it long enough. But that’s going to give you a false sense that you’re a smart investor.

Papasan: It might have been a bad decision that turned out OK, right? So, it all comes back to learn value, folks. Learn value.

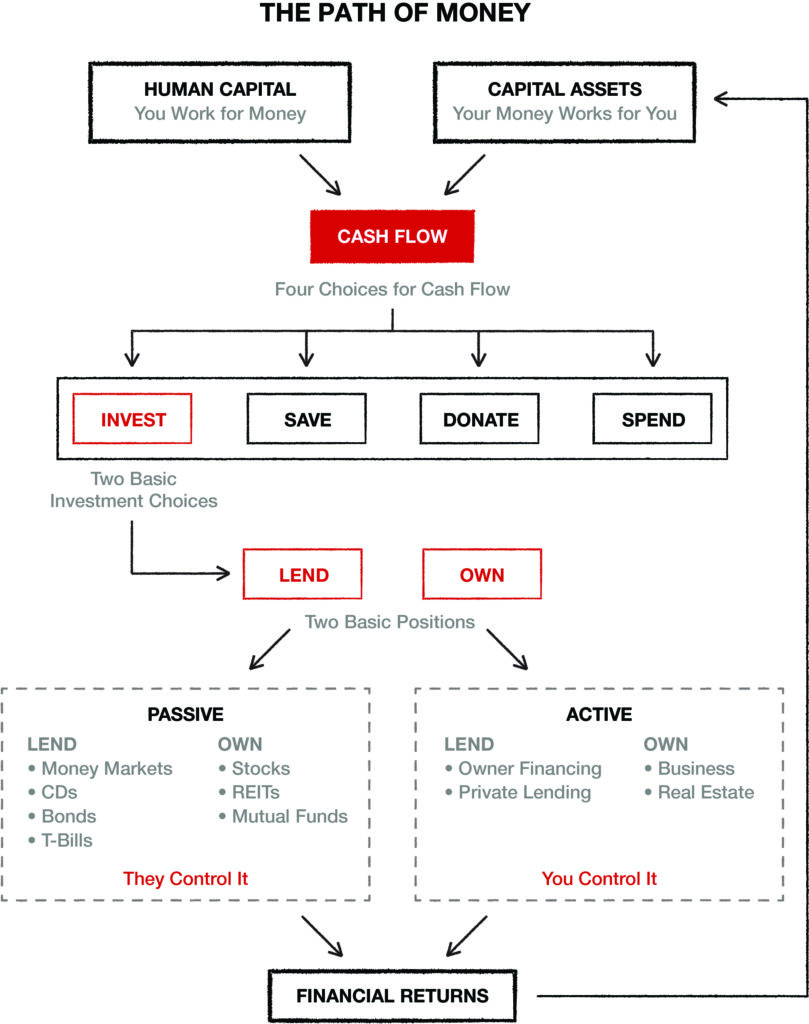

Lesson 4. Learn The Path of Money model.

Like lead generation, listings and leverage, having the right models and systems to work from can help you accelerate your success in wealth building. If you’re looking for a comprehensive model to help you understand what to do with your money, go straight to episode three where Keller and Papasan verbally walk through The Path of Money.

Keller: I’ll tell you how this came about. And that is I’m now forced to study investing. And so, I’m going to the books, and they’re all different. When I set the book down, I still wasn’t clear what I should do.

So, one day, I just sat down with a blank sheet of paper and had all these books in front of me, and I said, ‘OK. What are they telling me?’ And what I realized is it’s a treasure map. And what they’re telling me is the path of money, but none of them laid it out. So, I put it all together and the second I was done, it did the same thing for me that it did for you. All of a sudden, investing or the idea of how I should treat money became very, very obvious to me. And this became a mental map. Meaning, I see it in my head, and it guides me every day.

Lesson 5. Let your investments compound.

A lot of people dream of being a millionaire, but fall short of the dream because of avoidable circumstances. In episode four, Keller and Papasan neutralize 10 of these dream killers with sound advice, including the importance of letting your investments compound.

Papasan: When something is compounding and growing, the number one thing you want to do is do not interrupt the compounding process. You want that to keep going, and keep going, and keep going. I think one of our favorite authors, Morgan Housel, shared Warren Buffett- of the $85 billion or whatever he made- started investing when he was 10. I think 80 of that, he earned after he turned 65. So, he was just so good at using time to compound his money.

Keller: Well, the government tax issue. There’s an expense for you to visit your money. So, any time you go into an asset, and you sell that asset, so you can realize the gain, you’re going to get taxed on it again.

Papasan: We had to interview over 100 millionaires for The Millionaire Real Estate Investor, and we asked them: What was your biggest regret on the journey? A common phrase was, “I wish I had bought more and sold less,” once they understood over time how much compounding happened. One investor shared, “I can’t even drive down the street anymore because I just can’t bear to look at the property because I know how much money I lost by not being patient.”

Keller: Everybody has that. I have it too. Your goal is to minimize that.

Lesson 6. Set up a financial scorecard.

While financial freedom differs from person to person, the way to achieve it looks the same across the board. In episode five, Keller and Papasan discuss 10 steps entrepreneurs can take in their personal and professional lives to gain the financial independence they seek and ultimately, live a life worth living. Step 1. Create a financial scorecard.

Keller: This, literally, is your own profit and loss statement (P&L) and your own network balance sheet. And the P&L is nothing more than the worksheet that the bank will ask you to do if you apply for a loan. They’re going to ask you to put all your income and expenses, which- when you subtract them- will show a dollar amount either positive, or negative, or zero. And then, they’re going to ask you to list all your assets and all your liabilities and subtract the liabilities from the assets to tell you what your net worth is. Ultimately, what they want to see is what your cash flow is and understand what your net worth is.

Papasan: These are the same documents that every business runs on, but you can run on them in your personal life as well.

Keller: Yes. Anybody that intends to be financially free, financially solid and continually improve on their finances, is going to do this. They’re going to create a scorecard. I didn’t see the value in it until I actually went out, bought a car and dit he math. I realized I didn’t buy right and lost money because it was required that I had to put in the worth of it.

These 5 episodes were incredible!!!

I am hoping that pdf/resources are available soon(similar to the Path of Money above) on the 8 MythUnderstandings, 10 mistakes that keep people from being a millionaire, and 10 steps to financial freedom. Would be great to re-listen with those materials in front of you, possibly with an area for notes?

Thank you for the incredible content and insight.

Hi Matthew,

We’re so glad you enjoyed this season. Definitely passing this feedback on to the appropriate gatekeepers. In the meantime, explore more wealth-building stories through our archives:

Outfront Wealth-Building Archives