For many, the American Dream includes homeownership, yet according to the U.S. Census Bureau, almost 40% of people in the United States continue to rent. Intrigued, we sought to understand why renters are not buying and surveyed a random sample of 1,471 renters in the United States. Their responses revealed key insights.

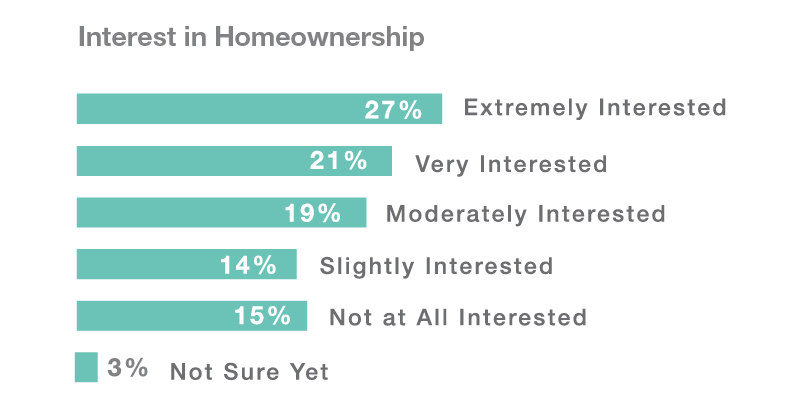

Despite nationwide dips in homeownership, a majority of renters are still interested.

Despite U.S. homeownership being at a 50-year low*, an overwhelming amount of respondents (81%) expressed interest in homeownership, with nearly 50% being “very or extremely interested.” Among those interested, over half (57%) indicated they would like to be homeowners within the next three years.

Why the disinterest?

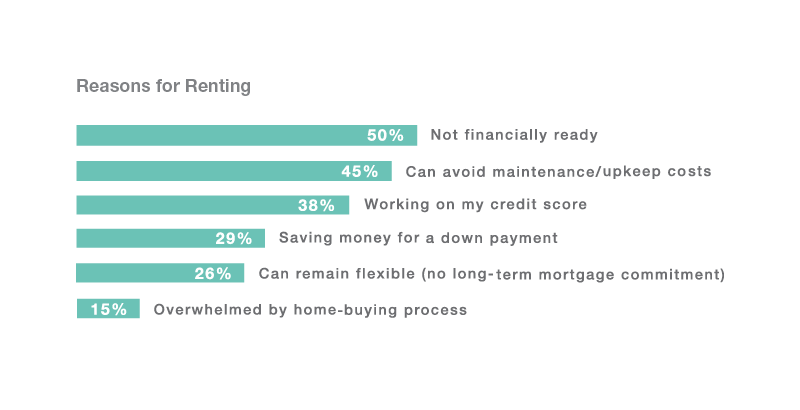

Within the group, 15% said they have no interest in homeownership at all, citing several reasons why they believe renting continues to be superior to owning:

- I do not have to worry about maintenance and upkeep costs. (71%)

- I have no long-term commitment to a mortgage. (39%)

- I am not financially ready. (36%)

What you can do: Replace fears with facts

Taking the plunge into homeownership can be scary. In Your First Home: The Proven Path to Home Ownership, Gary Keller, co-founder of Keller Williams, shares several scripts to use in your conversations with skeptical renters. Here’s one you can use right now.

Fear: I can’t afford to buy a home now.

Fact: Actually, you can’t afford NOT to buy a home.

The truth is, there is always a home you can afford to buy that will be a smart purchase for you. The earlier you buy, the earlier you will benefit from equity buildup and will be well-positioned for any future appreciation. The sooner and more seriously you begin the process of buying your home, the sooner you’ll find the best buy for you.

A majority of renters are taking financial initiative to own a home.

When we asked about hurdles to homeownership, we found that 63% of respondents had hesitations about homeownership and financial concerns represented the biggest hurdle. However, on a positive note, we saw that a majority of renters (67%) are proactively working on their finances to be able to purchase a home either by trying to improve their credit score (38%) or by saving money for a down payment (29%).

What you can do: Connect skeptics with a mortgage specialist

If your client believes their finances are hindering them from owning a home, connect them with a trusted mortgage specialist. A great mortgage specialist will reveal what they can qualify for and provide quality advice on how they can consolidate debts and if needed refer them to a credit counselor who can get them on the right track with their finances.

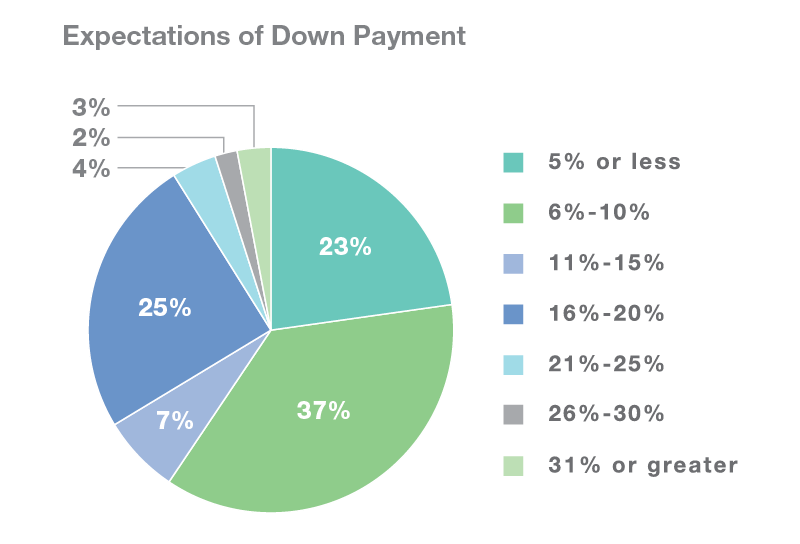

Significant knowledge gaps exist when it comes to the homeownership process.

When we asked renters what they thought the expected down payment on a mortgage was, answers varied. 60% of the renters believed the expected down payment was less than 10%, while 24% of respondents believed that the expected down payment should be 20%.

This points to significant knowledge gaps in the homeownership process, largely due to a lack of education. 41% of renters said they have never educated themselves on the homeownership process.

What you can do: Fill the gap

Reach out to renters earlier with education about the homeownership process with “Your First Home.” This free course, created by KWU, comes complete with a seminar package filled with marketing materials, a scripted PowerPoint presentation and more that will help you reassure renters that they are not alone while generating first-time home buyer leads.